A complete buyers guide to double glazing

Written by

Tuesday 25th October 2022

Upgrading or replacing your existing windows is no small feat and there's more to choosing new double glazing than just picking a style. You’ll need to consider if the style you like will actually suit your home, what frame material you should pick, the type of glazing is best and what opening options are most suitable.

So, to help you make the right decisions, and keep you safer, warmer, and happier for many years to come, Novuna Personal Finance have put together this practical and comprehensive guide to help you understand everything you need to know about double glazing.

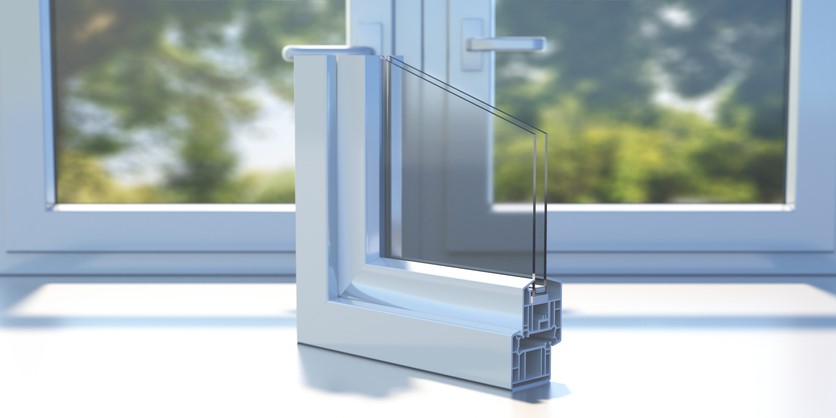

What is double glazing?

Double glazing is the process where two layers of glass are fitted together, and a small pocket of air is trapped in between. The gap is usually 12 to 16 mm wide and is filled with either normal dry air or argon gas.

As it’s designed to reduce heat loss and noise pollution, this makes it a popular choice for many homeowners with 6 out of 10 homes in the UK having double glazing. Unlike single glazing, double glazing could save you money on your energy bill and significantly reduce your carbon footprint.

How much is double glazing?

In the UK, the cost of double glazing can range anywhere between £150 and £600+ per window with quotes of £2,000+ being the industry standard.

There’s a lot of factors to consider which will affect the overall cost of double glazing from materials and design to window size and location.

It’s always worth the extra time and effort needed to research which company can give you the best price along with checking their accreditations and customer reviews.

How long does double glazing last?

With the advancements in manufacturing technology and better-quality products, modern double glazing is expected to last between 25 and 30 years!

What should I ask a double-glazing salesman?

Once you’ve got a few quotes from different companies, it’s always best to spend a little extra time finding out more and not just making your decision on price alone.

Below are our top 10 questions to ask before signing on the dotted line:

1. How long have you been in business?

Opting for a long-serving double glazier over a newly established installer will make it easier to figure out how skilled and dedicated they are. You’ll also be able to verify the quality of their work and customer service from online reviews.

2. What accreditations do you have?

One of the most important identifiers of a reliable company is to see what accreditations they hold in their field.

Accreditations show that your chosen double-glazing company, products, and employees have all been vetted and approved by independent bodies. Here are some of the accreditations you should look for:

- FENSA

- TrustMark Home Pro

- The British Fenestration Rating Council (BFRC)

- Technical Competencies certification

3. Do you offer an Insurance Backed Guarantee?

It’s a legal requirement for all double-glazing installers to offer an ‘Insurance Backed Guarantee’ when carrying out any installation. This protects you and your money if the company goes into liquidation.

4. What’s the final cost?

This might seem obvious, but any good company will provide you with an accurate estimation shortly after your initial consultation. Be sure to double check all the costs listed before signing on the dotted line to prevent any unexpected surprises later.

5. Do you have a showroom I can visit?

Most reputable double-glazing installer will have a dedicated showroom you can visit to help you get a feel for products before making a purchase. This will give you a better idea of what you’re choosing in a relaxed and pressure-free environment (hopefully).

6. Do you accept cash and card?

Trustworthy and reliable double-glazing installers will accept any major method of payment and not just cash in hand. A card transaction can be tracked in case you experience any fraudulent activity and using a credit card could give you the added protection of Section 75. Always make sure to get a full itemised invoice and receipt upon payment.

7. How long do installations usually take?

The size of your project will determine the installation time, however, make sure that your double-glazer has a solid plan and schedule in place prior to starting work.

8. Do you offer aftercare?

After every home improvement installation, there’s always the possibility something can go wrong. While it might be hard to prevent something like a leak or faulty fitting from happening, opting for a company that offers a dedicated aftercare service will provide you with peace of mind in the long term.

9. Do you offer additional glazing services?

Double glazing is quickly becoming the industry standard across the UK to ensure required U-Value levels are being met. To guarantee the very best thermal insulation and energy efficiency, opt for a tradesman that provides additional double or even triple glazing services.

10. How secure are your products?

Regardless of whether you’re getting new windows, doors, or a conservatory installed, never compromise, or sacrifice your safety or security by purchasing inferior products. Most modern products integrate multi-point locking as standard to help ward off intruders, but every product differs so make sure to find out.

Should I upgrade to a double-glazed front door?

Your front door can seriously impact the kerbside appeal of your property, so if you’re looking to improve the appearance of your home, the addition of a new double glazed front door could make a huge difference to your property.

The average price of a front door sized 900mm x 2,100mm can range anywhere from £600 – £800 but the final cost will vary depending on the style and finishes you choose.

Flexible finance options from Novuna Personal Finance

If you’re thinking of updating your old double glazing, investing in a new front door or having a conservatory installed, our low-cost home renovation loans and dedicated conservatory finance can put you in the strongest position to get a great deal. You can borrow between £1,000 and £35,000 with competitive rates from as low as 6.1% APR Representative (£7,500-£25,000) which can be spread over up to seven years.

Written by

Luke Hilton is a Warrington-based email content writer and designer in the financial services industry. He enjoys mixing analytics and creativity and can usually be found with his head buried in stats, piecing together the patterns that make good content. In his spare time, the drive to figure things out continues with what can only be described as a love-hate relationship with DIY. With a keen love of the outdoors, Luke is usually up a mountain somewhere or in his garden growing his own oasis.

Up Next

More articles we think you'll enjoy