It’s time to boost the EPC rating of your rental property

Written by

Friday 21st April 2023

With the UK still aiming to reach its net zero target by 2050, there’s an increased focus on homeowners – and landlords in particular – to do their bit.

The government are considering introducing new regulations that will require all newly rented properties to have an EPC rating of C or above from 2025 (or 2028 for existing tenancies). Many landlords are concerned about the financial impact of these proposed changes, which also include an increased fine for properties without a valid EPC. It’s thought that the introduction of the proposed requirements could have significant impact on the rental market as a whole, as landlords begin to consider whether to invest in energy-efficient property upgrades or potentially withdraw from the market.

A recent investigation found that six out of ten inspected rental homes in the UK would not meet the proposed new standard for energy efficiency. The time is now for landlords to start thinking about improving their rental properties before the new EPC rules potentially come into play.

Preparing for net zero

Net zero will be achieved when the amount of greenhouse gas emissions produced is balanced by the amount that’s removed from the atmosphere. For this to become a reality, the whole country is being encouraged to take collective responsibility over their own carbon footprint.

Energy consumption in the home is a particular issue. According to the Energy Saving Trust, energy use in the home accounts for 22% of carbon emissions in the UK. Homes in England produce 58.5 million tonnes of CO2 every year which is more than the 56 million tonnes of CO2 produced annually in the country by cars. Energy-inefficient homes are a big contributor to this.

Gas-guzzling central heating systems and poor insulation results in heat easily escaping from the property, requiring even more gas to keep the house warm.

The solution, undoubtedly, is to start making our houses more efficient. In this guide, we explain the importance of improving the EPC rating of your property – particularly for landlords.

New rules for rented property are on the horizon

Currently, the Minimum Energy Efficiency Standards (MEES) require all domestic properties being let or sold in England or Wales to have a minimum EPC rating of ‘E’ or above – but that could soon change.

The new Minimum Energy Performance of Buildings Bill proposes that by 2025, all new tenancies must have an EPC rating of at least C. By 2028, this will apply to all privately rented properties – including those with existing tenancies.

The new rules won’t apply to every single property (there are some limited exemptions). That said, with 60% of all homes in the country having an EPC of D or lower, the new regulations are likely to impact a huge proportion of domestic properties owned by landlords.

When will the plans be finalised?

The proposal forms part of the Minimum Energy Performance of Buildings Bill, which is awaiting its second reading in the House of Lords.

While there are reports that the deadline for new tenancies will be pushed back to 2028, this has yet to be officially confirmed.

What is an EPC rating and why do I need to improve it?

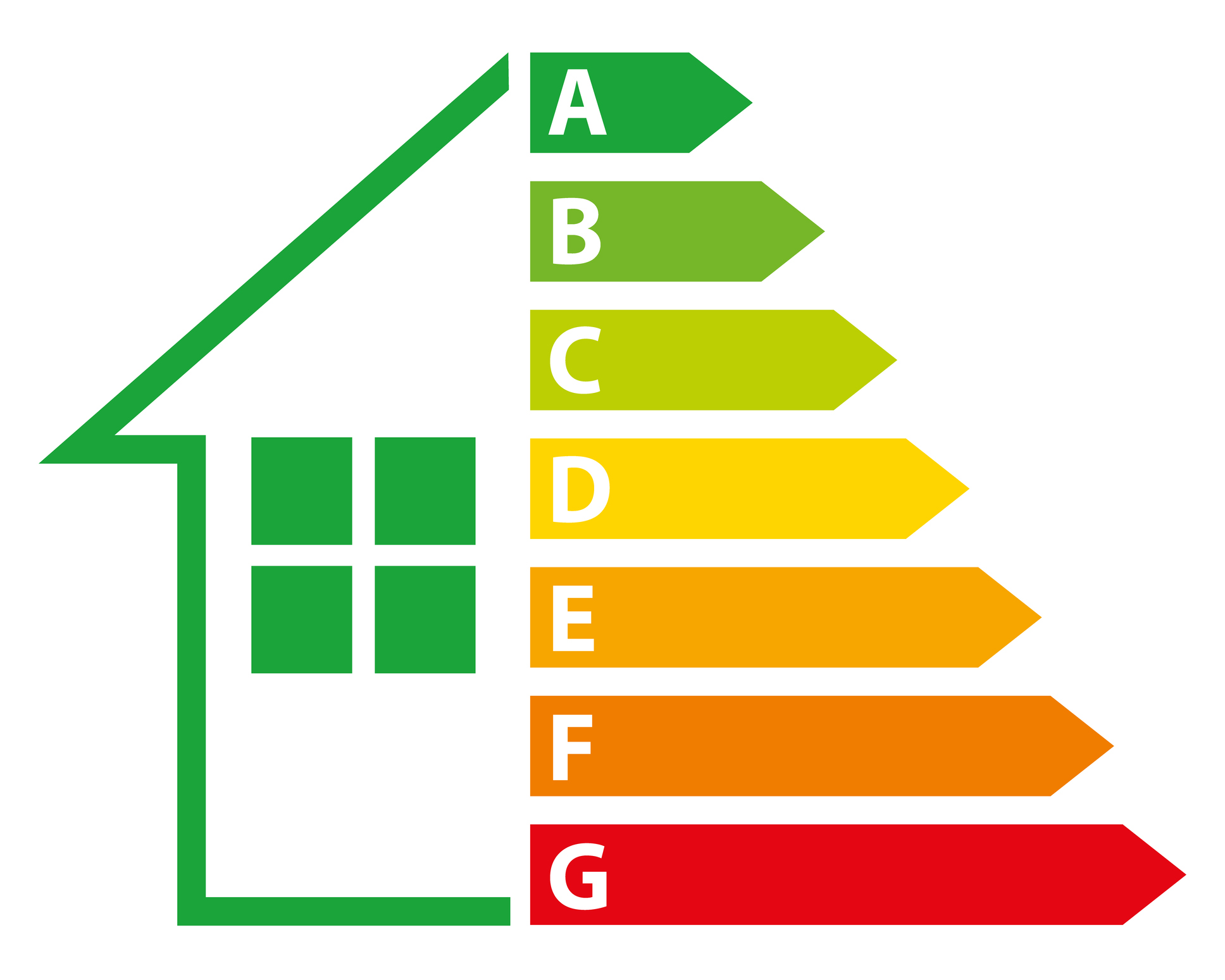

EPC stands for Energy Performance Certificate. It grades a property’s energy efficiency from A (most efficient) to G (least efficient) based on how energy is used within the property. The EPC will also show the potential rating your property could achieve if suggested improvements were made.

If you’re a landlord, you should know exactly what an EPC rating is and its importance. After all, landlords need to get a new EPC certificate every ten years, when you are entering into a tenancy with a new tenant or selling the property – whichever comes first. That said, it’s perfectly possible to get a new EPC sooner if you’ve made significant improvements to the property.

Without a valid EPC, you could be fined up to £5,000. It’s worth noting that this will change to a fine of £30,000 in 2025 if the Minimum Energy Performance of Buildings Bill is passed.

Common ways to improve your EPC rating

Your EPC will detail recommendations to improve the efficiency of your property, so it’s worth thoroughly reading through these and identifying the most suitable suggestions.

Always weigh up how much it will cost to make the improvements versus how much you could potentially save.

The most common ways to improve the energy-efficiency of a property include:

- Replacing an old boiler

- Investing in renewable energy

- Installing double or triple glazing

- Improving the insulation of the property, paying particular attention to the roof, loft and walls

- Installing a smart meter

- Fitting low-energy lighting

- Draught proofing the property

- Considering a secondary heating source

It’s thought a ‘fabric first’ policy will be introduced, which prioritises maximising the performance of the fabric of the building itself (windows, for example) before additional improvements (such as installing a new heating system) can be made. So, if you are considering investing in some upgrades before the proposed 2025 deadline, it could be a good idea to adopt this approach.

For further inspiration, read our blog on the eco-friendly home improvements you could make to your property.

The cost of improving the energy-efficiency of your rental property

Making improvements to reach the proposed minimum EPC C rating is estimated to cost around £4,700. While investment into energy-efficient improvements is currently capped at £3,500, under the new rules thought to be coming into effect in 2025, landlords will be required to make improvements up to the cost of £10,000 (inclusive of VAT).

£10,000 is still a lot of money to find – but there are several ways to fund energy-efficient improvements. These include using up some of your savings, remortgaging, or increasing the existing mortgage your property if you have one.

A home improvement loan is also one of the most popular ways to fund your eco-friendly renovations. Simply borrow the money you need and pay it back over a series of fixed-rate monthly instalments. With Novuna Personal Finance, you could borrow up to £35,000 at competitive rates from as low as 6.1% APR Representative (£7,500-£25,000).

An unsecured personal loan doesn’t require you to put up collateral, either. The lending decision will be made based on your personal and financial circumstances, credit history, loan amount and term.

Do you think a personal loan could be the right choice to help you improve your EPC rating?

Written by

Robert Walton is a Senior Marketing Manager with many years of experience helping brands reach the right customers through clear, informative and straight-to-the-point comms. He's all about delivering top quality customer service and shouting about the great things we do here at Novuna. In his spare time, Robert dabbles with DIY and likes to write about his home improvement tips and tricks.