Top home improvements to add value to your property

Written by

Monday 8th April 2024

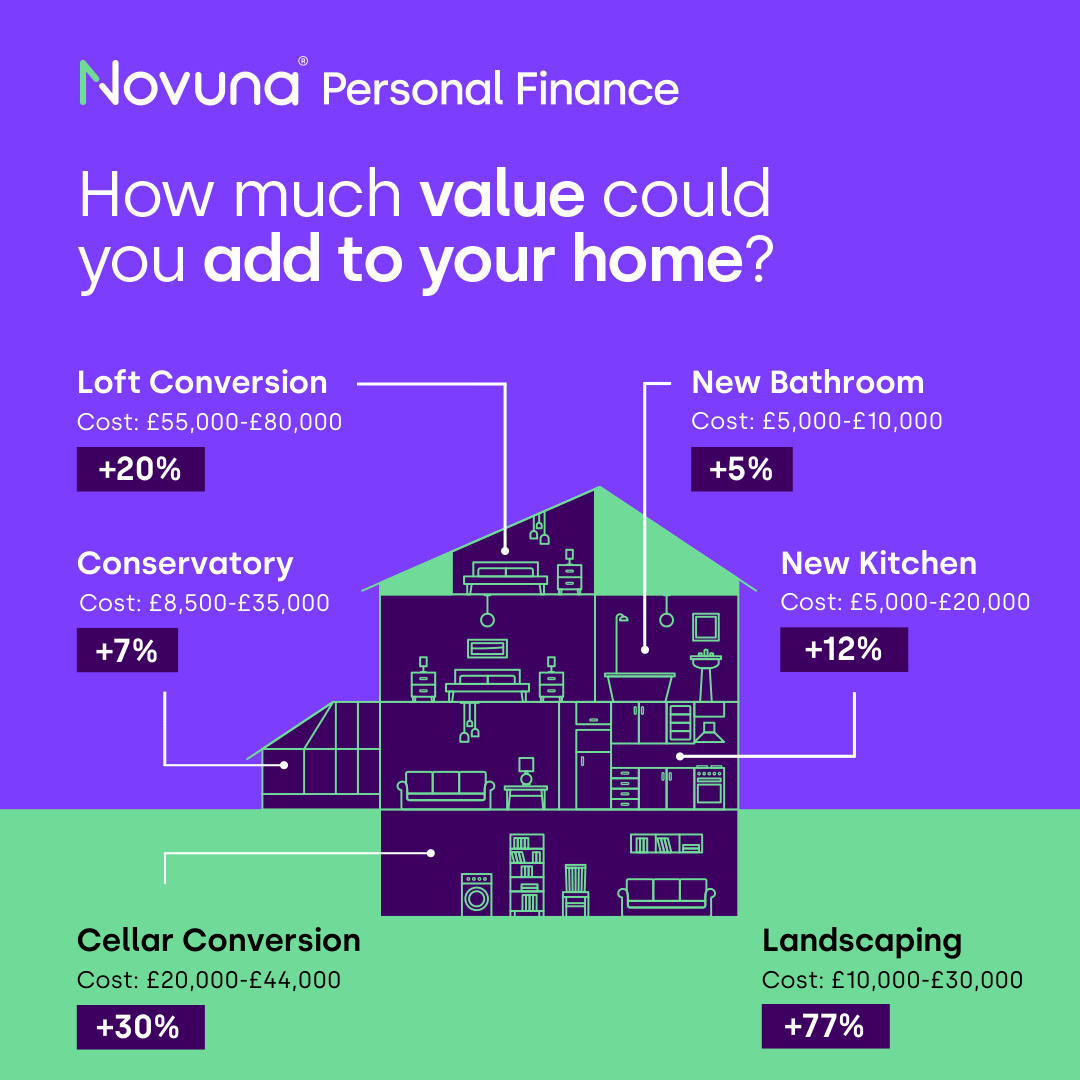

When you make home improvements to your existing property, not only can you create your dream home (adding space and improving functionality if required), but you could potentially boost its value!

Here at Novuna Personal Finance, we’ve put together a list of the top home improvements which will make your house a home and potentially add value to your property in the long run.

Make a splash by renovating your bathroom

Potential value added: 5% [1]

Initial outlay: £7,000 [2]

Our research showed that a whopping 86% of Brits would look for a new bathroom when buying a new house. So, if you’re thinking of renovating, a new bathroom could be worth considering.

Of course, ripping out your old suite and installing a brand new one is going to be an expensive option. But if you’re looking for an all-new effect on a budget, focus on only replacing the essentials. For example, you may want to keep your cistern, bath or vanity unit and only replace fixtures and fittings.

For a whole new look and feel at a cheaper price point, consider retiling. You’d be surprised how much difference even new grout and silicone edging can make.

Top tip: Though there’s been a recent trend for wet rooms and showers, think carefully before removing your bath during a renovation. Research suggests having a bath in the main bathroom could add 2% to your home’s value!

Cook up a new kitchen

Potential value added: 8% to 12% [3]

Initial outlay: £5,000 to £20,000 [4]

51% of homeowners say the kitchen is on their DIY waiting list. And, with 81% of prospective homeowners on the lookout for a property with an updated kitchen, it seems investing in a kitchen redesign could be a good move.

A full kitchen renovation can come with lots of moving parts, including plumbing and electrical work. But there are ways to keep the cost down with some creative DIY. For example, replacing your kitchen cabinet doors or laying new flooring can have a huge impact without breaking the bank.

Top tip: If you’re opting for a large-scale kitchen redesign, why not consider combining your dining or living room and kitchen to create an open-plan paradise? Make sure you do thorough research before going ahead, though, as you’ll need to instruct a professional if the wall between your kitchen and living room is load bearing.

Add a conservatory or garden room

Potential value added: 7% [5]

Initial outlay: The average cost of a conservatory ranges from £8,500 to £35,000 [6]

More and more homeowners require additional living space, and adding a conservatory or garden room provides more room for the family whilst still highlighting the importance of your outdoor space. Let the outside in with a conservatory or truly become one with nature by installing a hideaway home office at the bottom of the garden.

Adding a conservatory or garden room could increase the value of your home by between 5% and 10%, but this will depend largely on the quality and size of the build.

Do keep in mind that adding a conservatory is a big job and, though it’s a permitted development, you will need to be mindful of building regulations as well as any exceptions which will require you to make an application.

Top tip: If you already have a conservatory, you can add value by upgrading to a tiled roof. This will transform it into a living space you can use all year round - not just when the weather gets warmer!

Convert your loft into a useable living space

Potential value added: Up to 20% [7]

Initial outlay: £55,000 to £80,000 on average [8]

Loft conversions can make a huge difference to your house price. That said, the cost of the conversion shouldn’t exceed the added value to your house – so it’s worth doing your homework before calling in the builders.

You have lots of options when it comes to a loft conversion so you can choose the type that best suits your needs and your budget. For example, a rooflight loft conversion requires a minimal amount of structural work (making it the most cost-effective option). On the other hand, a mansard conversion is the most expensive option as it requires extensive alterations to the building.

Create additional living or storage space in your cellar

Potential value added: 20% to 30% [9]

Initial outlay: Around £32,000 for a 20m2 basement [10]

If you’re lucky enough to have a cellar or basement already, then converting it into an additional living or storage space has the potential to boost your property’s value by up to 30%.

A cellar conversion may be less complex than you’d expect, too, as it doesn’t require planning permission. That’s because it falls under the ‘change of use’ category. However, if you do want to make any structural changes, you’ll need to speak with your local planning authority first.

Landscape your garden

Potential value added: Up to 77% [11]

Initial outlay: Up to £30,000 [12]

With so many people choosing to spend more time at home, having an outdoor area is often top of the wish list. Create your perfect garden and you could see your house prices grow as potential buyers hunt for a house with a gorgeous green space to relax in.

You can transform a garden with very little money – buying a few plants or accessories could cost less than £100. However, if you’re wanting to really add the wow factor, expect it to cost you thousands to hire a professional landscape designer.

Decking or a patio can change a garden into a fabulous entertaining or hosting space, and creating simple ‘zones’ around your garden allows you to curate a multi-functional outdoor space complete with wildflowers, herbs and perhaps even a play area for the little ones.

The cost of home improvements

While undertaking home improvements could add value to your property, you should also consider how much the renovation will cost. Experts suggest having work done to your home will cost 17% more on average than in 2022 thanks to material costs and tradespeople increasing their prices.

You could save yourself thousands of pounds by developing your DIY skills and tackling home improvement projects yourself. In fact, a quarter of Brits say they’ve saved between £1,000 and £5,000 by doing home renovations themselves.

But which jobs should you take on yourself to add value to your home? In her expert guide, Kate Faulkner OBE explains which simple changes could mean sales.

Boost your budget with a home improvement loan

Finding thousands of pounds for your next renovation project can feel like a challenge. You might not want to dip into your nest egg, or you might not want to wait for your savings to build.

Get started on your home renovation project sooner with a low-cost home improvement loan. You can borrow between £1,000 and £35,000 with competitive rates from as low as 6.1% APR Representative (£7,500-£25,000). If your application is accepted, the money could be with you in just two working days.

Sources

Written by

Stephanie Reid is a financial services expert with over eight years of experience writing money-saving articles at Novuna Personal Finance. She has written hundreds of articles on a variety of topics including interior design, home improvements and weddings - with a keen eye for spotting money-saving opportunities and passing these tips onto readers. As a mum of two, Stephanie knows how important budgeting effectively is for parents and often incorporates family budgeting tips into her guides.