Personal loan vs credit cards

Written by

Thursday 2nd March 2023

Chances are you’ve borrowed money at some point – most of us have. Whether it’s for a new car, home improvements or to buy some of life’s little luxuries, borrowing money can help you to get to your goals sooner.

But should you use your credit card or apply for a personal loan?

Let’s look at the core differences between a credit card and a personal loan…

What is the difference between a credit card and a personal loan?

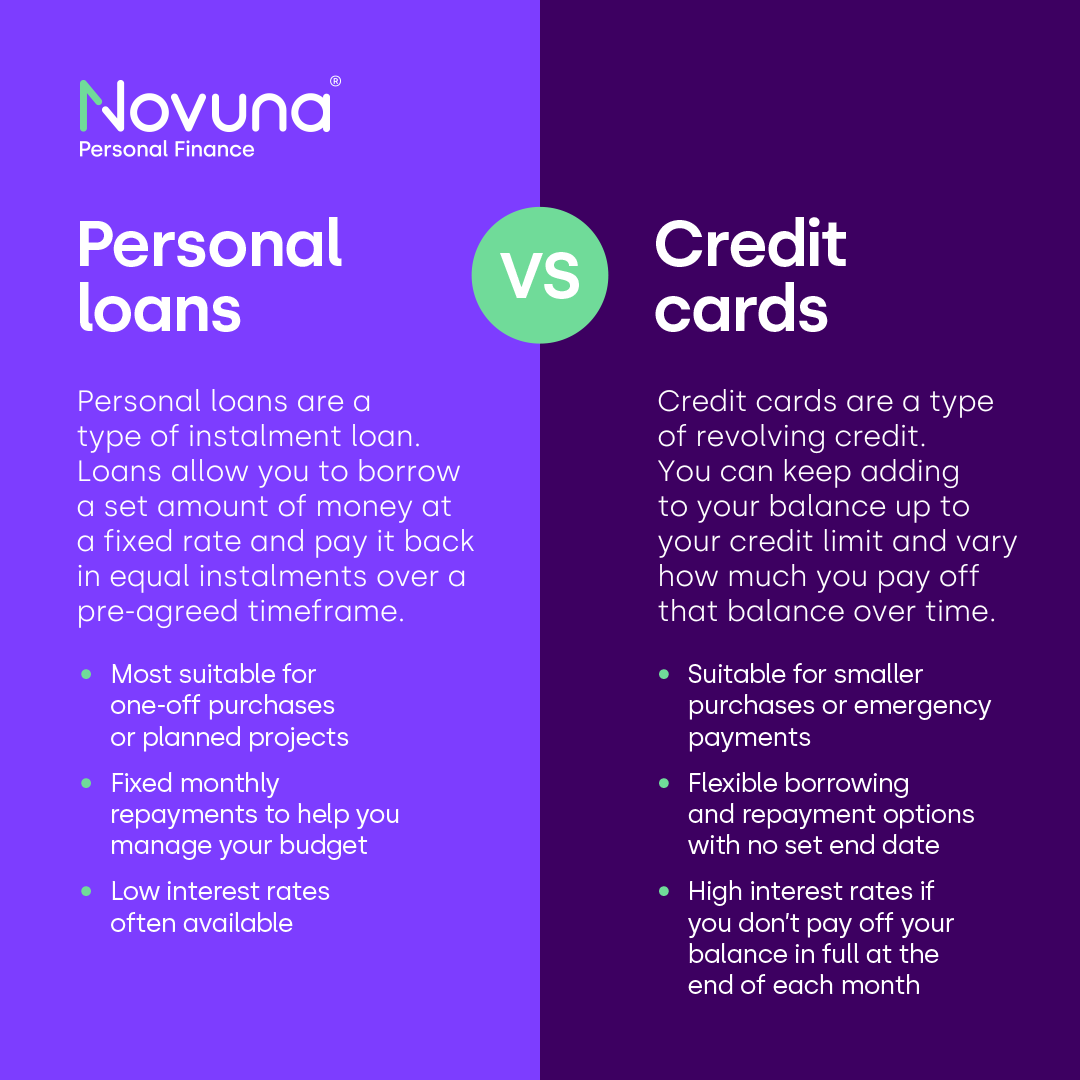

Both personal loans and credit cards offer a way for you to borrow money and pay it back over time. One of the main differences is that a personal loan is a type of instalment loan with a fixed term, whereas most traditional credit cards are a type of revolving credit.

With revolving credit, you can keep adding to your balance up to the maximum amount allowed (this is known as your credit limit). You can then vary how much you pay off that balance over time, though you will need to pay a minimum amount each month.

An instalment loan or instalment plan allows you to borrow a fixed amount of money and pay it back in equal instalments over a set amount of time until the amount you owe is fully paid off.

While instalment credit is more traditionally linked to loans, some credit card providers are now offering instalment plans. This allows you to make a series of equal payments over a fixed number of months. It’s worth noting, though, that each credit card provider will have different rules, eligibility requirements and charges. Instalment plans are often only eligible on a select number of individual credit card transactions, and any debt you’re paying off via an instalment plan will still be part of your credit limit.

Personal loans are perhaps most suitable for larger purchases, as most lenders have a minimum loan amount of around £1,000 and may offer the opportunity to borrow up to £35,000 and pay it back over a longer time frame. In contrast, credit cards usually have a lower limit which makes them more suitable for smaller purchases or emergency payments.

What is a credit card?

A credit card is a type of payment method that allows you to borrow money to pay for items or services. You’ll need to pay back the money you borrow plus interest and any fees or charges.

The average credit limit in the UK is between £3,000 and £4,000 but the amount you’re able to borrow will depend on your personal circumstances and credit history.

Credit cards offer flexible repayment options. Traditional credit cards allow you to either pay the full amount shown on your monthly statement before the end of each month, which means you likely won’t pay any interest at all, or opt for a lower repayment amount if you want to borrow over a longer period of time. You will always need to pay a set minimum amount, even if you decide to carry over your balance.

As mentioned, some credit card providers also offer instalment plans which allows you to spread the cost of your credit card transactions over a fixed term. This way, you’ll always know how much you need to pay each month which helps you manage your outgoings.

Depending on your credit history, you may qualify for introductory offers such as an interest free period for purchases made with your card. This makes using a credit card a cost-effective way to borrow, though you will be charged interest if you don't pay off your balance within this time frame.

When should I use a credit card?

Your credit limit is likely to be lower than the amount you’re able to borrow when you take out a personal loan. Therefore, it may be more suitable to use a credit card for smaller retail purchases.

Credit cards are also useful for an emergency back-up if something goes wrong (for example, a broken washing machine) and you need access to additional funds immediately. If you already have a credit card it can be the quickest way to pay for the goods and services you need, compared to waiting a couple of days for a personal loan application to be completed and the funds transferred.

What are the benefits of a credit card compared to a personal loan?

- If you already have a credit card, it could be quick and easy to borrow the money you need

- You won’t need to borrow a set amount – every time you make a purchase using your card, it’ll be added to your overall balance. This makes it a good way to pay for several smaller purchases

- You might be able to qualify for introductory offers such as an interest free period for purchases made with your card. This makes using a credit card a potentially cost-effective way to borrow. If you don't pay off your balance within the specified time frame or miss payments, you will have to pay interest

- You normally won’t pay any interest if you pay off your entire credit card bill each month, or if you choose to pay via an instalment plan with an interest-free option or introductory offer. This makes credit cards a suitable option if you can afford to repay quickly what you spend

- Your credit card provider might offer a rewards scheme or cashback for using their card, so you could benefit from your purchases

- You’ll have added peace of mind as credit cards fall under Section 75 of the Consumer Credit Act. For any purchases made between £100 and £30,000, your credit card company will support you in getting your money back should the seller not deliver as promised (for example, not deliver your goods or files for bankruptcy)

What is a personal loan?

A personal loan allows you to borrow a larger sum of money and you make your repayments over a set time frame (for example, between 2 and 7 years). This makes personal loans a good way to access funds you need for a big upfront purchase.

Unlike a credit card agreement, you’ll always pay the same amount every month for a set number of months as the amount borrowed, the interest rate and the repayment period are agreed up front. The fixed rate of interest and fixed repayment term allows you to borrow in a structured way, helping you to manage your budget more effectively.

When should I use a personal loan?

Personal loans are a good choice if you want to make a big purchase but don’t have the funds to pay for it all upfront. Spread the costs of home improvements, a new car, a wedding or even a holiday of a lifetime by making manageable monthly payments without needing to dip into your nest egg or delay your project or purchase while you save up.

You could also use a personal loan to consolidate other debts into a single, more manageable monthly payment. It’s often cheaper to use a low-interest loan to pay off other high-interest debts, and you’ll only have one monthly repayment to think about.

What are the benefits of a personal loan compared to a credit card?

- Personal loans are fixed rate. Your repayments will stay the same each month, so you’ll know exactly how much you need to pay and when, which helps you manage your outgoings

- You can usually borrow more money using a personal loan compared to a credit card, which makes a personal loan more suitable for significant purchases

- The repayment term is often spread over several years, giving you the flexibility to spread the cost over a longer time frame

- Our personal loans are a form of unsecured lending which means you don’t need to put up collateral, such as property assets, to be approved for a loan. Instead, the lender will consider your personal and financial circumstances, credit history, loan amount and term to help them make a decision

- Depending on your credit history, a personal loan could carry lower interest charges than a credit card, which has an average interest rate of 22%*

*Correct as of 02/03/2023 (Source: MoneyHelper)

Should I choose a personal loan or a credit card?

|

Personal Loan |

Credit Card |

|

You need to make a one-off, significant payment |

You’re making a series of smaller payments |

|

You’re making a planned purchase, such as buying a new car or campervan |

You need to make a payment urgently |

|

You prefer to know exactly how much is leaving your account and when, so you can budget more effectively |

You’re comfortable managing a varied amount of debt each month |

|

You would like to spread the cost of a large purchase over a longer time frame, helping to reduce those monthly repayments |

You’re only making a small purchase, and can make the full repayment at the end of the month (so you can avoid paying interest) |

|

You want fixed-rate interest charges and certainty over what you will pay for the loan |

You prefer to pay off your debt manually (for example, if your salary varies each month) |

|

You have a good credit score, and are therefore more likely to be offered a lower interest rate |

You have a less-than-perfect credit score and want to be able to demonstrate responsible debt management to help improve your ability to borrow in the future |

Remember, whichever personal finance product you choose, the most important thing to consider is how much you can afford to borrow and if the repayments fit within your budget. You’ll need to pay the balance, any interest payable and any fees and charges applied so do consider these before applying for a credit card or a personal loan.

Are personal loans or credit cards cheaper?

This depends on how you manage your finances.

If you intend to take out a 0% interest credit card and repay any debt before the interest-free period ends, or you’ll only spend what you’re able to repay in full at the end of month, a credit card could be a more cost-effective option as you won’t incur any interest charges.

However, if you’re looking to make smaller repayments over a longer period of time, you could find a credit card quickly becomes an expensive way to borrow. If you only make minimum payments on your credit card, it’ll take much longer to pay off your debt and also means you’ll end up paying more interest in total.

For larger purchases, personal loans could be the cheaper way to borrow in the long term. This is because your interest rate will be fixed throughout your term, so you’ll always know how much your repayments will be. Depending on your credit history, loan amount and term, you could be offered a market-leading interest rate.

Are personal loans better than credit cards on a credit report?

Both personal loans and credit cards form part of your credit mix and can impact your credit report. However, depending on how you manage your finances, the impact might not be negative. In fact, both forms of lending can give your credit score a boost providing that you make all repayments on time every month for the full term. This shows that you’re able to do a good job of managing your debt.

However, if you make late payments or miss them entirely, this will show on your credit report and is likely to harm your credit score, potentially making it more difficult – and more expensive – to borrow in the future.

Pay particular attention to your ongoing credit card usage, as you’ll be able to demonstrate responsible borrowing by keeping your credit consumption below 30% of your credit card limit.

If you have a strong credit score, you are more likely to be eligible for a low-interest personal loan or higher credit limit on a credit card. However, if you are struggling to get credit due to a lack of credit history, a credit builder credit card could have a positive impact on your credit report. These cards often have low credit limits and high interest rates. This limits the risk for the lender but gives the borrower an opportunity to demonstrate they can manage debt effectively by paying off the card in full each month.

Find out more about personal loans

With a personal loan from Novuna Personal Finance, you could borrow between £1,000 and £35,000. Our guide shares everything you need to know about personal loans, to help you understand whether a personal loan is the right choice for you.

Written by

Sophie Venner is a Yorkshire-based content writer specialising in crafting content for the financial services industry. She’s written over 300 articles on finance, but she’s covered everything from insurance to digital marketing trends. Her content has been featured in the likes of Semrush, Digital Marketing Magazine and Insurance Business.