Online loan calculator

How much will a Novuna personal loan cost you?

Find out how much it might cost to borrow the money you need in seconds. Use the loan calculator below to get an idea of how much your monthly payments might be, based on the rates the majority of our customers receive for those amounts.

Representative Example:

£{value}

{value}% APR

£{value}

£{value}

{value} months

A loan of £7,500 over 5 years: rate of interest 6.3% (fixed), 6.3% APR Representative, monthly repayment of £145.42, total repayment of £8725.20. Remember, the rate you are offered may vary due to personal circumstances and loan amount, the majority of our customers receive the advertised rate. However, if you complete an application directly via the Novuna Personal Finance website and are given a higher APR, we guarantee that you'll never pay more than £244.09 per month with our maximum 34.9% APR Representative when you borrow £7,500 over 5 years*. The maximum APR you could be offered when you borrow other loan values is 36.4%*. All loans are subject to status. *For applications carried out directly via the Novuna Personal Finance website.

Please enter a loan amount using the plus or minus keys or by typing into the field.

To make things a little easier for you to find the right loan amount and term, please note:

- The loan amount should be between £1,000 and £35,000 only

- You can borrow between £1,000-£7499.99 over a period of 2 to 5 years only (24 months to 60 months)

- You can borrow between £7,500-£25,000.99 over a period of 2 to 7 years only (24 months to 84 months)

- You can borrow between £25,001-£35,000 over a period of 4 to 5 years only (48 months to 60 months)

You can enter a loan amount using the plus and minus keys or by typing into the field

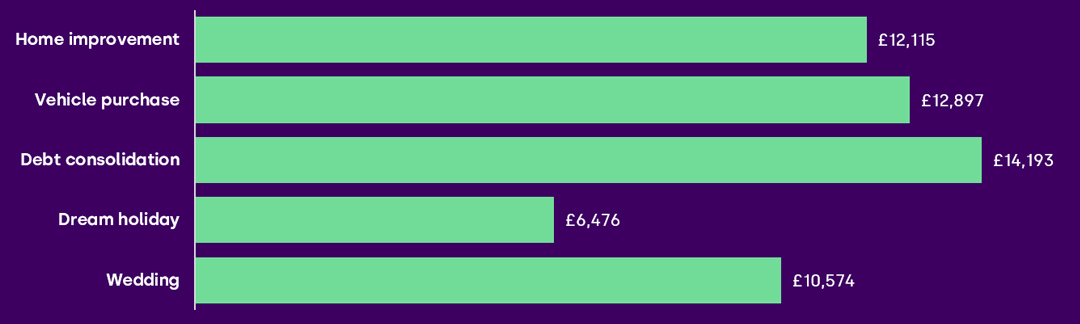

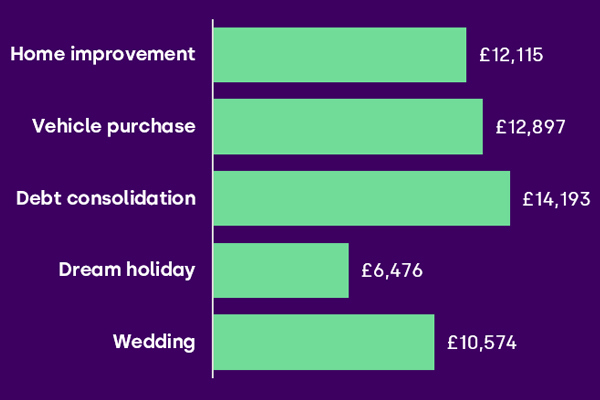

How much are people borrowing from Novuna?

Over the last 6 months we've asked all our customers what they were borrowing money for and here's the results. So whatever it is you're dreaming of, big or small, our loans of £1,000 to £35,000 are helping thousands make their important thing happen.

How our loan calculator works

Our loan calculator automatically displays estimated monthly repayment costs and total amount payable based on the loan amount and term you input. This could help you to work out whether a loan is affordable for you.

The loan calculator results are based on our advertised rate, which is the rate at least 51% of customers are given. Your personalised loan APR will only be calculated at the point of application once we know more about your personal circumstances and credit history - as well as the amount you’d like to borrow and over how long.

Loan calculator FAQs

- How do I use the online calculator?

- Will the loan calculator impact my credit score?

- How is my loan APR calculated?

- What is an advertised rate?

- How do I get a personalised quote?

- Is this an unsecured loan calculator?

- Can I calculate interest with the calculator?

- How do you calculate the monthly loan payment?

How do I use the online calculator?

It’s easy to use our quick personal loan calculator. Simply enter the loan amount (or your monthly budget) and term. You can use the plus or minus keys or type into the field. We’ll then show you estimated monthly repayment costs and total amount payable, based on our advertised rate.

Our advertised rate demonstrates the rate at least 51% of our customers are given, giving you a realistic idea of the type of APR to expect when you apply with us. The rate you’re offered once you’ve completed an application form will be based on your personal circumstances, loan amount and term.

Find out estimated monthly repayments on a specific loan amount in seconds. You can also find out how much you could borrow based on your monthly budget, which will help to make sure you don’t apply for a loan that might be difficult to repay.

Please keep in mind:

- The loan amount should be between £1,000 and £35,000 only

- You can borrow between £1,000-£7499.99 over a period of 2 to 5 years only (24 months to 60 months)

- You can borrow between £7,500-£25,000.99 over a period of 2 to 7 years only (24 months to 84 months)

- You can borrow between £25,001-£35,000 over a period of 4 to 5 years only (48 months to 60 months)

If you’re happy with the estimated monthly repayment figure, click ‘Apply Now’ and fill out our quick and easy online application form. It’ll take less than ten minutes to fill out, and you’ll get an instant decision based on your current financial situation and loan amount.

Will the loan calculator impact my credit score?

Using our online loan calculator will not impact your credit score. We will only conduct a hard credit check when you fill out an application form. For more information, check out our personal loan FAQs.

How is my loan APR calculated?

Your loan APR will be calculated at the point of application once we know more about your personal circumstances and credit history — as well as the amount you’d like to borrow and over how long.

APR, which stands for Annual Percentage Rate, is determined by the interest rate and any additional charges you’ll pay when taking out a personal loan. As we don’t charge any fees, the APR and interest rate will be the same when you take out a loan with us.

Find out more about the difference between APR and interest rate here.

What is an advertised rate?

The advertised rate, sometimes known as a headline rate or Representative APR, is the rate that is given to at least 51% of customers.

You are more likely to be given the advertised rate if you have a good credit history and meet our loan eligibility requirements.

How do I get a personalised quote?

Our online loan calculator provides a quote based on representative APR, which is the rate that is given to the majority of our customers. Your personalised rate may differ once you’ve filled out an application form and told us a little more about your personal circumstance, loan amount and term.

To get a personal rate, fill out an application form or contact our Loans team on 0343 351 9112. Please be aware that, to assess your creditworthiness, we will need to conduct a credit check for each application you complete.

Is this an unsecured loan calculator?

Yes. Novuna Personal Finance offers unsecured personal loans, allowing you to spread the cost of a big purchase without needing to put up a valuable asset such as a house or car as collateral.

For more information, read our guide on the difference between unsecured and secured loans.

Can I calculate interest with the calculator?

Our loan calculator generates results based on the advertised interest rate, which changes based on loan amount.

The majority of customers will receive the advertised rate, but the APR you’re offered may differ at the point of application based on personal circumstances, loan amount and term.

How do you calculate the monthly loan payment?

Monthly loan payment is calculated by dividing the total amount payable (which includes interest) by the number of months it’ll take to pay off your loan.

If you’re ready to achieve your dreams, our calculator will give you an idea of how much interest you’ll pay overall to get you the cash you need sooner.

Looking for more information on our loans?

Personal Loans

Make it today, not one day. Whatever you need our low-rate personal loan for, with us you could borrow between £1,000 and £35,000 over 24 to 84 months.

Car Loans

Make it the car that’s made for your life journey. With our car finance, the money could be in your bank within 48 hours (excluding weekends and Bank Holidays).

Home Improvement Loans

Make it a place to love, not just to live. If you need help turning your house into your dream home, we can help with our low interest home improvement loans.

Take control of your loan

Manage your account 24/7 online or by downloading the Novuna app. It’s simple to set up and log in, giving you instant access to everything you need.